Blue-Chip Artists Lead Sotheby’s to $186.1M in Sales, Exceeding Expectations

Sothebys Contemporary Art Auction: Last week, Sotheby’s iconic New York saleroom on York Avenue played host to its marquee Contemporary Art Evening Auction, realising a formidable $186.1 million. The results not only exceeded presale expectations but reaffirmed the resilience and prestige of blue-chip contemporary art in the portfolios of the world’s most discerning collectors.

In an increasingly volatile economic landscape, this auction served as a stark reminder: fine art remains a bastion of cultural significance, wealth preservation, and strategic capital allocation. For collectors with an eye on legacy, diversification, and long-term value, the sale marked yet another endorsement of art as a meaningful asset class.

Headline Sales: Basquiat, Richter, Twombly Lead the Evening

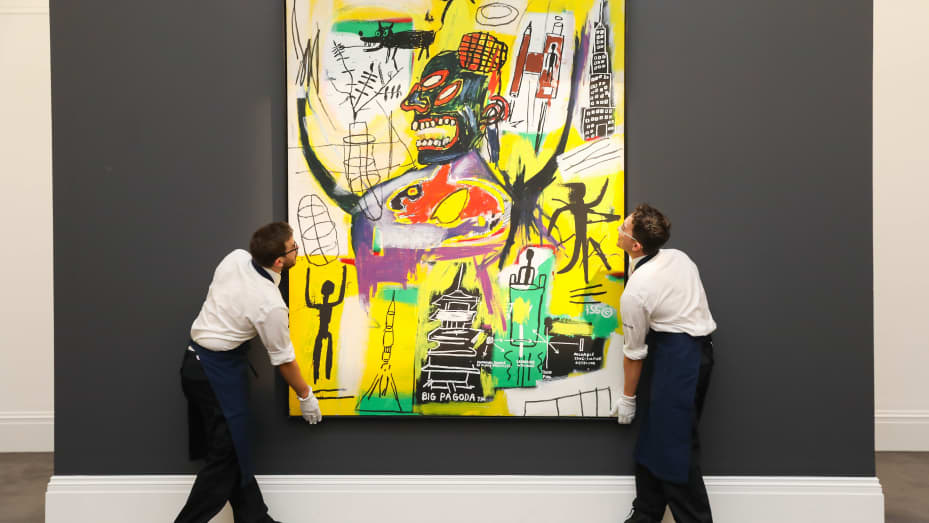

The spotlight was predictably drawn to Untitled (EL MARA) by Jean-Michel Basquiat—a 1982 acrylic and oilstick work, which achieved $28.5 million, comfortably surpassing its $20 million low estimate. While shy of his $110.5 million record set in 2017, this result affirms Basquiat’s place among the most dependable names in post-war collecting.

Gerhard Richter’s Abstraktes Bild (649-2), a textbook example of his acclaimed squeegee technique, fetched $22.8 million, reinforcing his global appeal and solidifying his stature as a cornerstone in institutional and private collections alike. Meanwhile, Cy Twombly’s Untitled (from his later period) achieved $15.3 million, again exceeding estimate—a testament to the enduring resonance of his calligraphic visual language.

Other highlights included works by Yayoi Kusama, Mark Bradford, and Julie Mehretu, all of whom saw strong competitive bidding, demonstrating the market’s continued appetite for both global contemporary icons and boundary-pushing voices.

With a sell-through rate of over 90%, the sale underscored the potency of expertly curated catalogues and the sophistication of today’s collector base.

Emerging Signals: Collectors Diversifying with Confidence

Beyond the headline figures, the auction revealed broader signals: rising interest in mid-career and emerging artists. Works by Jadé Fadojutimi, Shara Hughes, and Salman Toor outperformed estimates, indicating a robust appetite for the next generation of blue-chip talent.

This shift suggests that collectors are not simply preserving capital—they are actively shaping the canon of contemporary art. The willingness to invest early in rising stars reflects a forward-thinking, risk-balanced strategy, particularly relevant in an art economy that now rewards both taste and timing.

The Strategic Value of Art in Wealth Planning

For ultra-high-net-worth individuals, auctions like this are more than spectacles—they are barometers of global wealth and sentiment. Amid inflationary pressures and shifting monetary policies, tangible assets such as fine art offer a compelling hedge and an emotional dividend that traditional investments rarely provide.

The $186.1 million result affirms that top-tier artworks continue to serve as long-duration assets—combining cultural cachet with financial strength. From tax planning and legacy structuring to family office diversification, contemporary art is increasingly being integrated into broader wealth strategies.

Moreover, ownership of significant works carries weight beyond the balance sheet—it signals taste, influence, and a lasting contribution to the cultural discourse.

Final Thoughts for Discerning Collectors

Sotheby’s recent performance is more than a market headline—it’s a call to action. For those seeking a stable, culturally significant investment with long-term upside, blue-chip art remains unmatched. Whether you’re expanding a curated collection or entering the art market for the first time, opportunities lie not just in ownership, but in storytelling, legacy, and cultural impact.

📩 Considering Art as Investment?

Get in touch with our team here if you’d like to discuss strategic entry into the contemporary art market. Whether you’re looking for private acquisitions, discreet sourcing of rare works, or insights into emerging artist opportunities, ELEVEN28 offers unmatched access and curation.

No responses yet